What Is DeFi? A Beginner’s Guide To Decentralized Finance

If you’ve invested in bitcoin or done any research into cryptocurrency, you’ve probably heard the term decentralized finance (DeFi) once or twice.

One of the most important promises of cryptocurrencies is to provide access to payments and finance to everyone in the world, wherever they are. As a result, DeFi supporters see it as a better alternative to traditional financial services.

But what is decentralized finance (DeFi)? How does it stack up against the traditional financial system? In this beginner’s guide, we’ll discuss everything you need to know about this new financial system that could change the world.

What is Decentralized Finance – DeFi?

Decentralized finance (DeFi) is a new financial system built on safely distributed ledgers like those used by cryptocurrencies. The method removes bank and institution control over money, financial goods, and financial services.

One of the newest and most advanced technological trends in recent history is the cryptocurrency revolution. New sectors have emerged as a result, including bitcoin investing and decentralised exchanges (DEXs). Decentralized Finance is one new industry in the blockchain environment that is gaining popularity. Anyone with an internet connection will be able to invest in projects thanks to the DeFi financial system.

In comparison to traditional banks, DeFi charges less. Many people have even taken out and returned loans reaching millions of dollars without providing any kind of identification.

In addition, DeFi also functions without the need for traditional, centralized intermediaries. It can be transmitted through transactions between two parties without the need of any intermediaries (banks), making it challenging for governments or other third parties to detect or control. This allows cryptocurrency users to send money between parties while maintaining their privacy.

How does DeFi work?

DeFi uses cryptocurrencies and smart contracts to offer financial services, eliminating the need for intermediaries such as guarantors. Services such as lending (where users can lend their cryptocurrency and earn interest in minutes instead of once a month), getting instant loans, trading peer-to-peer without a broker, saving cryptocurrency and better interest rates accrued. Bank purchasing commodities like futures contracts and stock options.

Users utilise dApps to perform peer-to-peer business transactions, with the majority of these apps being located on the Ethereum network. Coins (Ether, Polkadot, Solana), stablecoins (whose value is tied to a currency like the US Dollar), tokens, digital wallets (Coinbase, MetaMask), DeFi mining (also known as liquidity mining), yield farming, staking, trading, and borrowing, lending, and saving using smart contracts are some of the more popular DeFi services and dApps.

DeFi is open source, which means that the protocol and app are theoretically open for users to observe and innovate. As a result, users can mix and match protocols to unlock unique combinations of opportunities by developing their own dApps.

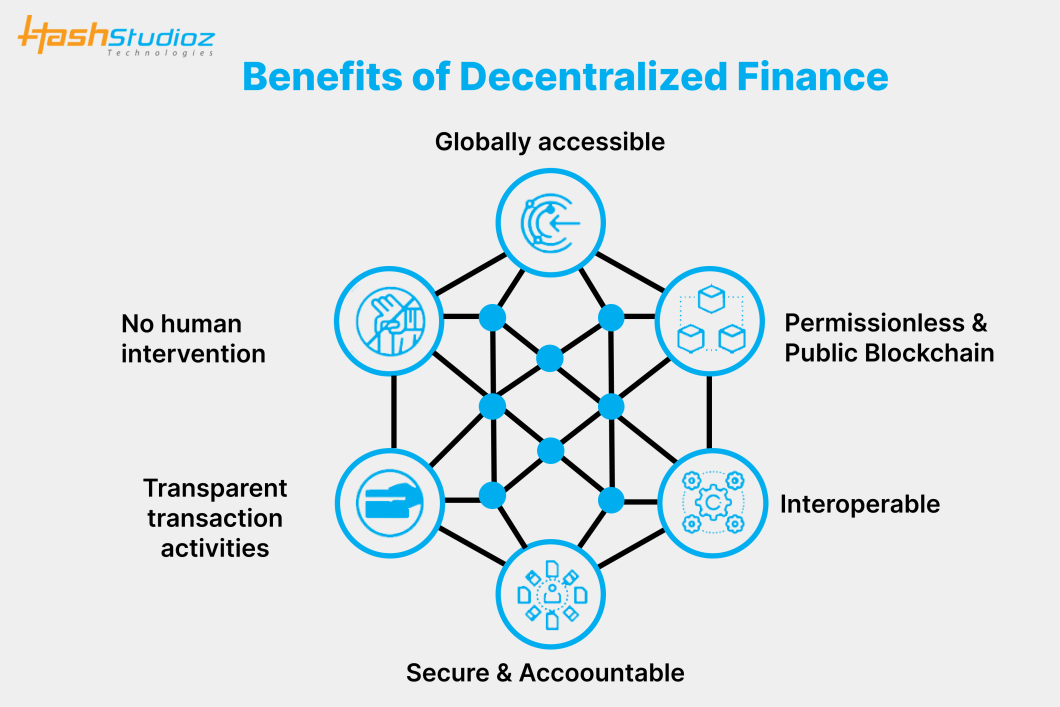

Benefits of Decentralized Finance

Now, the next important issue in understanding Decentralized Finance DeFi refers to its advantages. Although DeFi has many benefits, let us focus on the important mentions that contribute to the practice’s growing acceptance.

Security: The first step in a successful blockchain implementation is the development of a new architecture that reduces single points of failure and depends less on intermediaries. This is appropriate for financial transactions since the blockchain will ensure that prevented third-party intermediaries from mismanaging, abusing, or otherwise tampering with users’ money in any way. It promotes users’ confidence in the platforms.

Transparency: Blockchain technology creates a single common source for all network members and standardizes common activities. Any blockchain platform’s transactions are permanently recorded and may be viewed and verified.

Programmability: Blockchain technology allows for the safe automation of business processes through the creation and execution of smart contracts.

Non-custodial: As a result, third-party custodians become unnecessary because these business processes won’t need their help. Saving money is possible with this method.

Democratization: No matter where you are or what authority you are under, you can access it. Just being able to connect to the Internet is all that users require. In the context of DeFi, blockchain technology will give a chance for users to participate in the financial system without opening a traditional bank account.

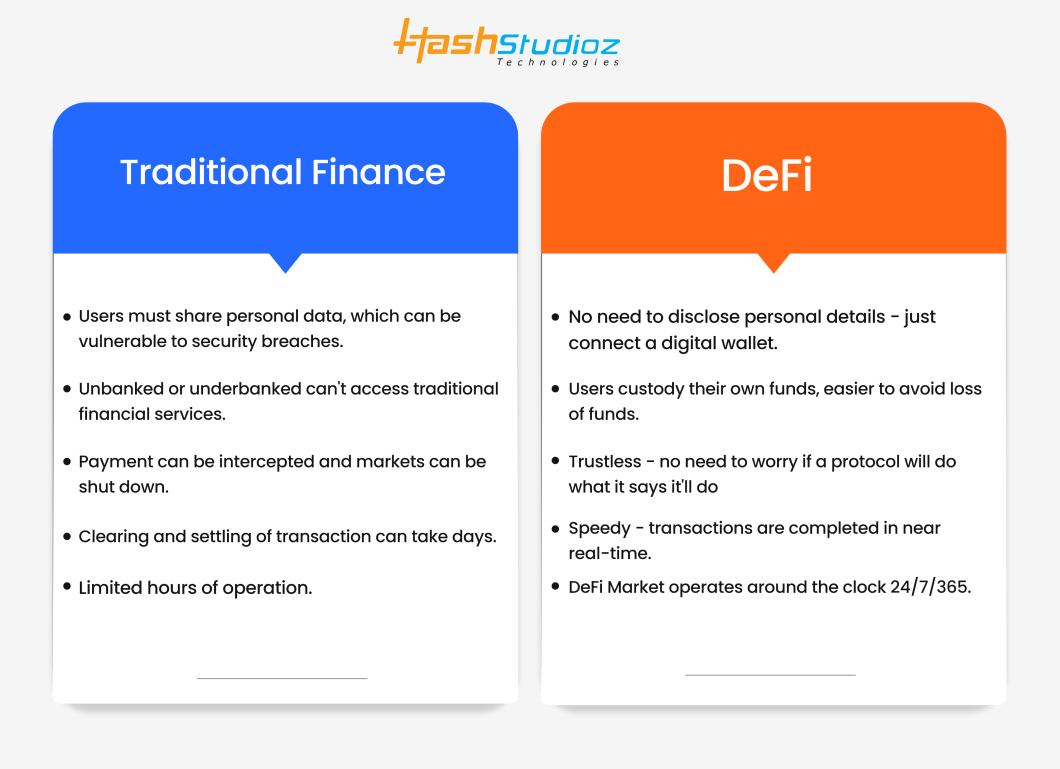

DeFi vs. Traditional Finance

A good way to comprehend DeFi is to compare it with the current traditional finance system (TradFi). Although both DeFi and conventional finance are systems that are created to support people in managing their money and conducting transactions, they operate very differently.

Asset classes and procedures are managed by businesses or individuals in centralised finance. A group of smart protocols are used in decentralised finance to handle assets.

The following are some key ways that DeFi differs from its more established competitors:

Management

DeFi apps are not handled by organisations and their employees, like traditional finance. Instead, smart contracts usually referred to as codes, contain regulations.

On the blockchain, smart contracts are applications that run automatically when specific criteria are satisfied. The DeFi apps can operate on their own with little to no human intervention once a smart contract has been published to the blockchain. However, in reality, developers are typically responsible for bug fixes and upgrades to the DApps.

In contrast, traditional finance depends on human interaction to perform its tasks.

Transparent Coding

Anyone can audit the blockchain’s code because it is transparent. A higher level of user trust is developed because anyone can discover faults and understand how a smart contract works.

Additionally, everyone has access to view transactions. Even though transactions are usernames and not directly associated with your real identity, they can also create privacy and security issues.

In the traditional banking system, customers do not influence the creation or upkeep of financial products.

Accessibility

Depending on the institution, different financial products are accessible in different ways. International transactions are more difficult to complete than local transactions, which are often simple. For example, you will probably need to utilise a third-party service that charges transaction fees and conversion costs if you live in the U.S. and want to transfer money to someone in Denmark.

DeFi is designed to be globally accessible this year, so no matter where you are, you can use the same services. The majority of DeFi apps are available to everyone with an internet connection, however, local laws may still be in effect.

Permissionless

DeFi applications are open source, making it possible for anybody to develop and use them. This works counter to traditional financial systems, which include a lot of intermediaries and need complicated procedures for account opening. DeFi, users can directly contract with smart contracts through their crypto wallets.

User Experience

It isn’t much you can do if you don’t like the user interface of the mobile app for your bank then complain to customer care or move banks. However, you can use a third-party interface or even create your app if you don’t like the DeFi app’s interface.

What are the Potential Use Cases for DeFi?

Borrowing And Lending

One of the most common application areas in the DeFi ecosystem is open lending protocols. Comparing open, decentralised borrowing and lending to the conventional credit system reveal significant benefits. There are no credit checks, rapid transaction settlement, and the option to use digital assets as collateral.

These lending services reduce the amount of trust required and provide the security of cryptographic verification techniques because they are built on public blockchains. Blockchain-based lending platforms reduce counterparty risk while increasing accessibility to borrowing and lending by lowering costs and processing times.

Monetary Banking Services

Financial applications and monetary banking services are an obvious use case for them because DeFi apps are by definition financial applications. Stablecoins, mortgages, and insurance are a few examples of them.

The development of stablecoins is becoming more important as the blockchain industry develops. These simple digital assets are crypto assets that are frequently linked to physical assets. Decentralized stablecoins could be used as regular digital currencies that are not issued and regulated by a central authority due to the sometimes-rapid fluctuations in cryptocurrency pricing.

Getting a mortgage is expensive and time-consuming due to the numerous intermediaries involved. Legal and underwriting costs might be greatly decreased using smart contracts.

The ability to distribute risk between many contestants and do away with the need for middlemen is made possible by insurance on the blockchain. Low premiums with the same level of service are possible as a result of this.

Check out How Blockchain Technology Will Impact the Banking Industry to learn more about blockchain and banking-

Decentralized Marketplaces

Some of the most popular DeFi applications are Decentralized Exchanges (DEXs), such as Binance DEX. These platforms allow users to trade digital assets without requiring a dependable third party (the exchange) to keep their money in reserve. Smart contracts are being used to relate to the performance exchanges between user wallets.

AMMs (Automated Market Makers) are exchanges that use liquidity pools to enable trading without directly requiring a counterparty to match your trade. Pancake Swap and Uni Swap are two of the best-known examples. Decentralized exchanges usually charge lower trading costs than centralised exchanges because they require less management and maintenance effort.

Numerous traditional finance products can also be issued using blockchain technology allowing for ownership. These applications would operate decentralised, doing away with custodians and single points of failure.

Platforms for the issuing of security tokens, for example, may offer issuers the resources and tools necessary to introduce tokenized securities with a range of customizable attributes. Other initiatives can make it possible to create derivatives, synthetic assets, decentralised prediction markets, and many more things.

Yield Optimization

DeFi DApps can be used to automate and improve the compound return from staking, reward pools, and other interest-bearing goods. On occasion, yield farming may be used to refer to yield optimization.

For example, mining Bitcoins, delegating BNB, or offering liquidity can all result in recurring payouts. Your rewards are used through a smart contract to buy more of the underlying asset or to make new investments. Your interest will increase thanks to this process, frequently greatly increasing your returns.

Of course, you can carry out this task manually. However, using a smart contract speeds up compounding and saves time. Your funds are typically combined with other users, which means that gas costs are shared by all participants in the yield-optimizing smart contract.

Why is Decentralized Finance(DeFi) Important?

DeFi wants to build a free, open financial market. DeFi has experienced significant expansion and investment, thus it’s crucial for financial advisors to understand this area. A lot of the technology in the DeFi domain expands upon and enhances the TradFi system, which might benefit users like you and your clients. Understanding decentralised finance and being able to work with and rely on these applications is crucial as the market develops and grows.

Challenges Associated With DeFi

Poor Performance: Applications based on blockchains are affected by the fact that they are intrinsically slower than their centralised counterparts. These restrictions must be considered by DeFi programme creators who must then optimise their work.

High Risk of User Error: DeFi applications transfer the responsibility from the intermediaries to the user. This can be a negative aspect for many. Designing products that minimize the risk of user error is a tough challenge when the products are deployed on top of immutable blockchains.

Bad User Experience: At the moment, using DeFi applications needs extra work from the user. DeFi applications need to offer a real advantage that encourages users to leave the traditional system to become a fundamental component of the global financial system.

Cluttered Ecosystem: Users must have the skills to identify the best options because it can be difficult to find the application that best fits a certain use case. Building applications is difficult, but it’s also difficult to think about how those applications will fit into the larger DeFi ecosystem.

Where Can I Find DeFi Projects?

DeFi has historically called Ethereum it's home. But there are now several blockchains available with strong DeFi ecosystems. DeFi DApps can be hosted on almost any network that supports smart contracts. Along with Fantom, Solana, Polkadot, and Avalanche, BNB Smart Chain is a well-liked option.

The research will be necessary to locate projects and DeFi protocols. You can learn about fresh chances through browsing websites, online forums, and instant messengers. However, you must use any information you obtain with utmost caution. Be cautious at all times and confirm the security of any project you read or hear about.

What Do I Need To Access DeFi Projects?

To connect to DeFi DApps, you’ll need:

1. A compatible Wallet. It can be done via a mobile wallet like Trust Wallet or a browser extension wallet like MetaMask. You have a lower chance of being able to connect to DApps if you use a custodial wallet (one in which you do not control the private keys).

2. Crypto. Although it can seem straightforward, you may require a variety of resources. For example, BNB will have to cover your gas costs if you use any DApp on the BNB Smart Chain. You’ll need bitcoin to use Ethereum (ETH). Two coins of equal value are required if you wish to start using liquidity pools and manually stake.

At its most basic, that’s all you’ll need. If you don’t feel comfortable setting this up yourself, you can still access some DeFi services through a centralized entity. We’ll cover this in a later section discussing centralized finance (CeFi).

The Future of Decentralized Finance

DeFi aims to establish an unregulated, permissionless, and open financial market. DeFi has undergone significant growth and investment, therefore financial advisors must comprehend this area. The TradFi system is built upon and improved by much of the technology in the DeFi domain, which might benefit users like you and your clients. It is critical to understand decentralised finance, be ready to interface with these applications, and rely on them as the space continues to develop and grow.

How HashStudioz Can Help You Create A DeFi platform?

Building financial services outside of the established political and financial systems is the main goal of decentralised finance. This would make it possible for a more transparent financial system and may help avoid global precedents for censorship, financial surveillance, and discrimination.

Decentralization is not always advantageous, despite being an attractive idea. Building a valuable stack of open financial products requires identifying the use cases that are best suited for blockchain development companies.

DeFi has the potential to transfer control from huge, centralised corporations to the individual and the open-source community if it is effective. After DeFi is accepted by the general public, it will be determined whether that leads to a more effective financial system.

Please visit our Blockchain Development Company page if you have any concerns or would like more details about it. Feel free to contact us. We are one of the leading Blockchain Development Companies in the industry.

Our expertise in various domains like Android App Development, ioS Application Development, and Blockchain App Development will help you build the solution.

Comments